MOBILIST Spotlights Public Markets’ Role in Financing the Global Goals at UN’s High-Level Political Forum

UK and Kenyan governments introduce MOBILIST to 80 representatives from UN nations and their partners and spotlight the role of public markets and listed products in financing the UN’s Global Goals.

[New York] On the 11th of July, the UK and Kenyan missions to the UN hosted leading stock exchange representatives to hear how listed products – those traded on stock exchanges – can spur progress towards the Global Goals. The event was part of the UN’s High-Level Political Forum on Sustainable Development’s focus on SDG: 17, ‘Partnership for the Goals’ and explored how public and private sectors can collaborate and innovate to mobilise capital.

The High-Level Political Forum is a periodic stocktake for the Global Goals 2030 agenda held at the UN headquarters in New York. Even before COVID-19, financing for the Sustainable Development Goals was falling $2.5 trillion short. In 2020 alone, the annual SDGs financing gap for emerging and developing economies grew by a further $3.7 trillion.

Welcoming over 80 UN Ambassadors, policymakers and partners, Dame Barbara Woodward and Ambassador Martin Kimani, the UK and Kenyan governments’ permanent representatives to the United Nations in New York made strong representation for new and innovative financing solutions that could help deliver investment at scale to developing nations. The event was recorded and is available to watch here.

“We are here because we need innovative solutions to get the SDGs back on track,” noted Dame Barbara Woodward. “Governments working with public markets can provide stability, scale and the good governance needed to solve long-term risks, like climate change.”

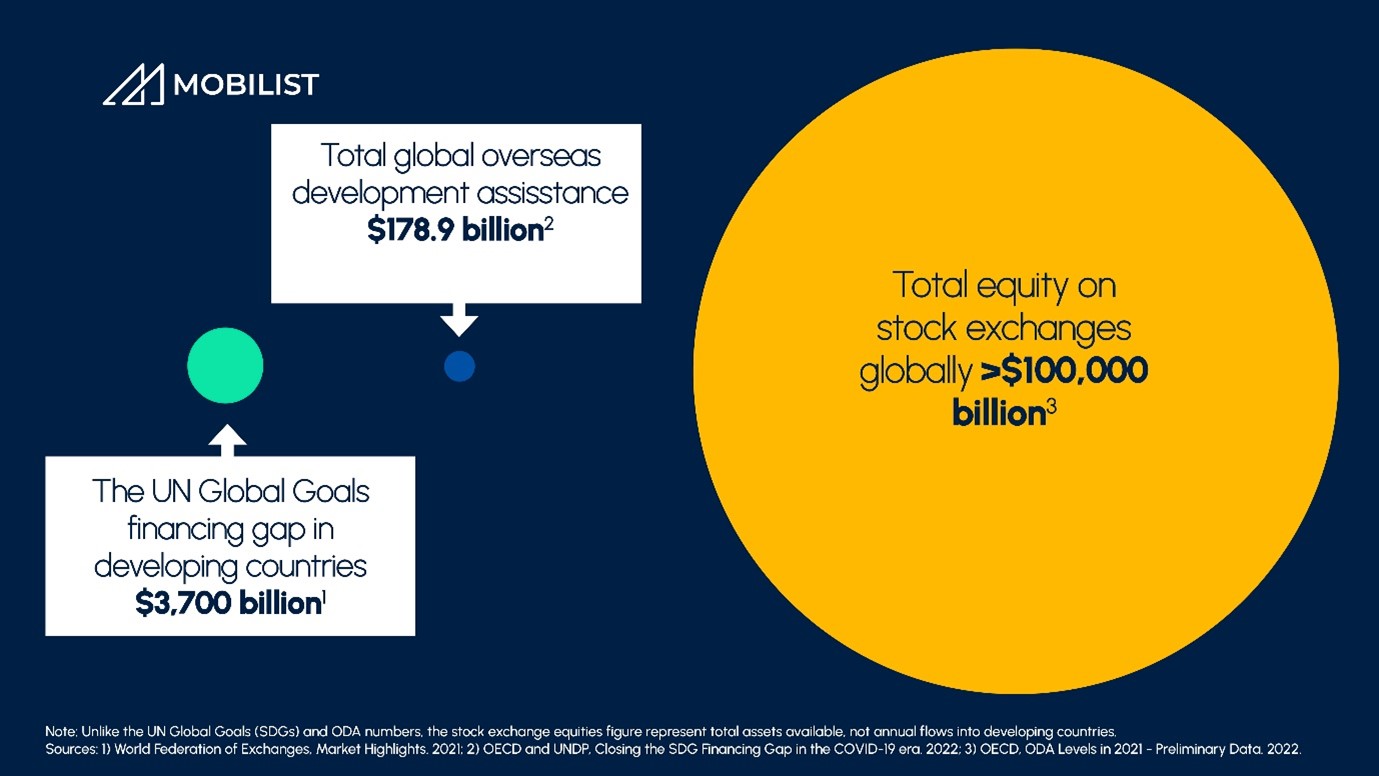

Representative Woodward spoke about the recent G7 Summit announcement of a $600 billion (USD) Partnership for Global Infrastructure and Investment (PGII) and the important role that private capital is expected to play in delivering on these commitments. The Ambassador noted that by creating new opportunities for even a small fraction of the capital available in public markets towards developing countries could help fill developing countries’ sustainable development financing gap (see graphic below).

Caption: A visualisation of the amount of capital needed to fill the SDG financing gap in developing countries and the total global overseas development assistance and equity of stock exchanges.

Representatives Woodward and Kimani then introduced MOBILIST and the network of stock exchanges it collaborates with: B3 – The Brazilian Stock Exchange’s Cesar Sanches, the Johannesburg Stock Exchange’s Shameela Soobramoney, the London Stock Exchange’s Tom Attenborough, and SGX Group’s Herry Cho.

The stock exchange speakers underscored the role of public markets in financing SDG-aligned and commercially viable opportunities globally as well as MOBILIST’s role in catalysing finance towards emerging markets. The representatives finally shared their thoughts on the importance and shape of public market mobilisation in their home regions.

“With their deep pools of capital, there is a greater role for public listed markets to play in driving investments in sustainable infrastructure, jobs and sustainable economic growth. Investments that push forward the UN Global Goals and promote inclusive growth in Latin America are vital to the region’s future.” Cesar Sanches, Head of Sustainability, B3 – The Brazilian Stock Exchange

After the stock exchange representatives finished their keynote addresses, the floor opened to questions from policymakers. From disclosure and data standards to the cost of not meeting the SDGs and the importance of dialogue, the discussion on the role of public markets in funding the SDGs was wide-ranging and succeeded in drawing attention to the relationship between supportive policy environments and public market mobilisation.