Source

First, MOBILIST sources eligible products. We tap into a global network of intermediaries who can bring to our attention products with the potential to be listed on MOBILIST partner stock exchanges in developed, frontier and emerging markets.

Search

Filter results

Showing 1 - of

Investment information

Evidence for policy making

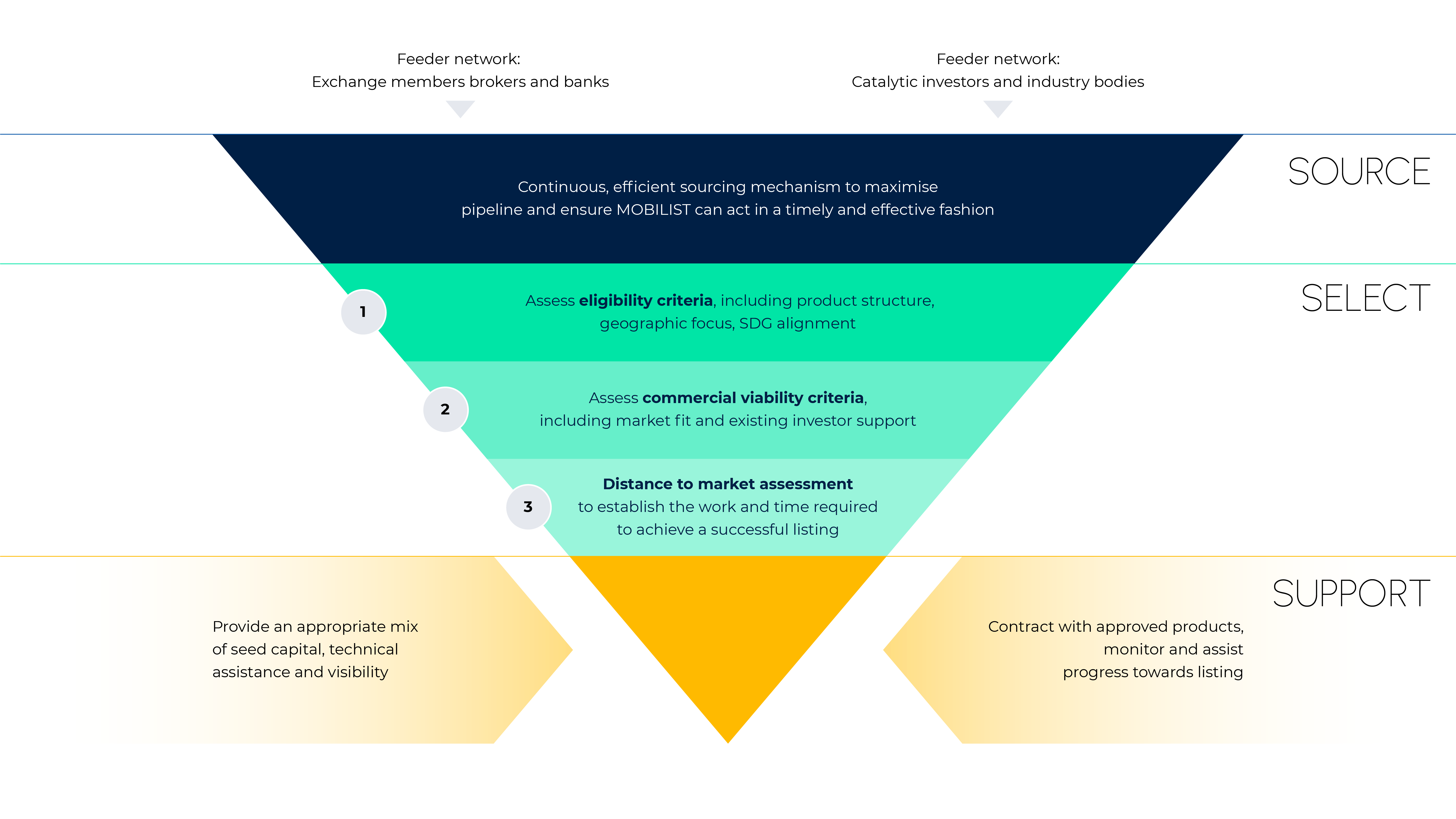

Using competitive quarterly windows, MOBILIST identifies investment products that meet the UK government’s eligibility criteria and demonstrate the strong potential to list on international and local exchanges. To do this, we use our Source, Select & Support (“S3”) Process. The S3 Process is designed to leverage existing market infrastructure and identify new products seeking to list on major stock exchanges. By evaluating and selecting the most promising products, MOBILIST can deliver the right blend of support where and when it is most needed.

First, MOBILIST sources eligible products. We tap into a global network of intermediaries who can bring to our attention products with the potential to be listed on MOBILIST partner stock exchanges in developed, frontier and emerging markets.

Second, we competitively select the product proposals most aligned with MOBILIST’s Investment Appetite Statement. Through an appraisal process, the MOBILIST team assess the ability of products to qualify for support (the eligibility criteria), their ability to attract funding (the commercial viability criteria) and the amount of work and time required to achieve a successful listing (the distance to market assessment).

Third, MOBILIST supports selected products with an appropriate mix of equity capital, technical assistance and enhanced visibility through UK government platforms, guidance and backing. The programme, the UK government and the applicant work together to identify the optimal support for each selected product.

MOBILIST can deploy technical assistance funding to help applicants reduce the at-risk costs involved in listing. This assistance is available to cover key costs related to preparing and structuring a product for a successful listing. This could, for example, include support for drafting an investment prospectus or the generation of regulatory assessments. Beyond transaction-level support, MOBILIST can review and provide assistance to applicants on potential reporting structures and their implementation. We provide technical assistance on ESG and development impact, particularly in regards to measurement, monitoring, validation, due diligence and strategic learning.

Potential products are assessed based on their ability to meet MOBILIST’s core eligibility criteria. The criteria are described in further detail in our Investment Appetite Statement, but the core principles are:

Products that meet the core eligibility criteria are then assessed based on commercial viability criteria. This includes evidence of support from cornerstone investors and a clear fundraising strategy.

A further assessment of the product’s distance to market (such as engagement of legal counsel and progress on listing documentation) helps ensure that selected products are appropriately supported towards listing.

Technical assistance is provided based on criteria such as the ability to offer the quickest route to listing without creating market distortions or the potential to serve as a public good for market development beyond MOBILIST.

MOBILIST offers catalytic cornerstone investment in the form of equity capital and targeted technical assistance funding to assist prospective issuers in structuring their public market offerings and measuring performance.

MOBILIST partners with key stock exchanges and seeks to support the listing of new products.

We are seeking to work with public markets brokers and investment banks — referred to collectively as ‘intermediaries’ — to share information and identify prospective products that are eligible to receive MOBILIST funding and support.

MOBILIST is actively looking to support the listing of products on our partner exchanges. MOBILIST will continue to form new partnerships with additional stock exchanges over time.

Applicants seeking support from MOBILIST should ensure that prospective products meet all eligibility criteria.

In addition, applicants must have already engaged the services of an accredited intermediary. An established working relationship with an intermediary is a necessary prerequisite to ensure that applicants are adequately resourced to align with MOBILIST’s mission to support investment products that use public markets to raise capital. If you require assistance locating intermediates in your home markets, please reach out to MOBILIST.

Find out whether your organisation or product meets MOBILIST’s eligibility criteria for investment. Please check MOBILIST's request for proposal below.

Read now